IMPACT READY MATCHING FUND (IRMF)

Get rewards for building up your impact management systems

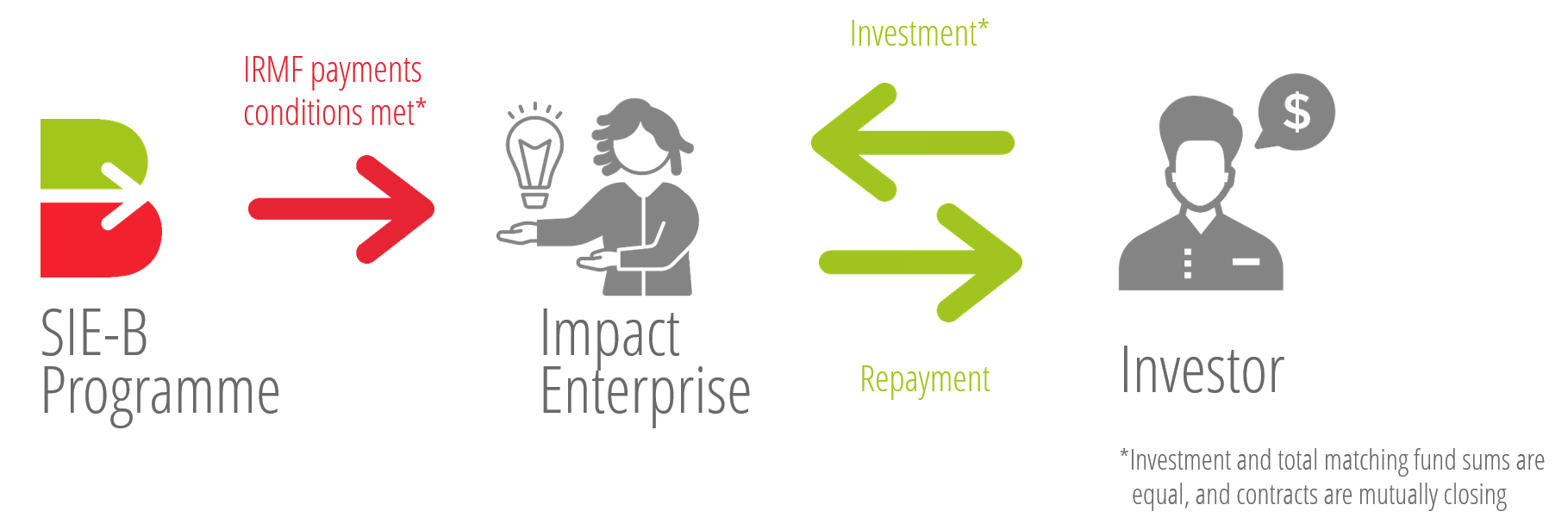

How does the Impact Ready Matching Fund (IRMF) work?

Enterprises receive financial rewards for improving their impact measurement & management (IMM)

IRMF is non-repayable funding that rewards enterprises for elevating their IMM capacities. It’s a hybrid financial instrument with elements of Impact-Linked Finance and capacity building. If you are an early-stage impact enterprise, you will be able to apply for this non-repayable funding that matches a recent seed investment and financially rewards you for building up your IMM systems. Impact enterprises are eligible to receive up to USD 100,000 – more detailed information can be found here.

How you can apply

The IRMF application has closed for the time being

This innovative catalytic funding instrument aims to financially reward early-stage impact enterprises for developing impact measurement and management systems. You can find out more details by reading the PDF below.

What are the eligibility criteria

These were the criteria we used to select impact enterprises

- You are legally registered in Bangladesh

- You raised repayable investment (not grants) within the last six months or are seeking to raise repayable investment

- You have a functioning business model with a track record of paying customers

- You have achieved breakeven or are expecting to within the medium term

- You have a business model that explicitly seeks to address social and/or environmental challenges (or must articulate a willingness to shift their business model towards these aims)

- You have a business model that serves customer groups considered to be under-served within Bangladesh