INNOVATIVE FINANCE TOOLKIT

Innovative ways to finance impact enterprises

Get inspired with our Innovative Finance Toolkit!

Alternative finance for impact enterprises in Bangladesh – and beyond

We need to redefine the terms of investments to better fit the unique attributes of impact enterprises — whether it be more patience, unconventional repayment options, or rewards for impact. In this toolkit, we want to highlight some of the alternative structures that can be used to support impact enterprises on their journeys to create much-needed impact at scale. GET THE ENTIRE INNOVATIVE FINANCE TOOLKIT HERE or select individual instruments below. Here you’ll also find case studies and additional resources.

Some snapshots from inside the Innovative Finance Toolkit!

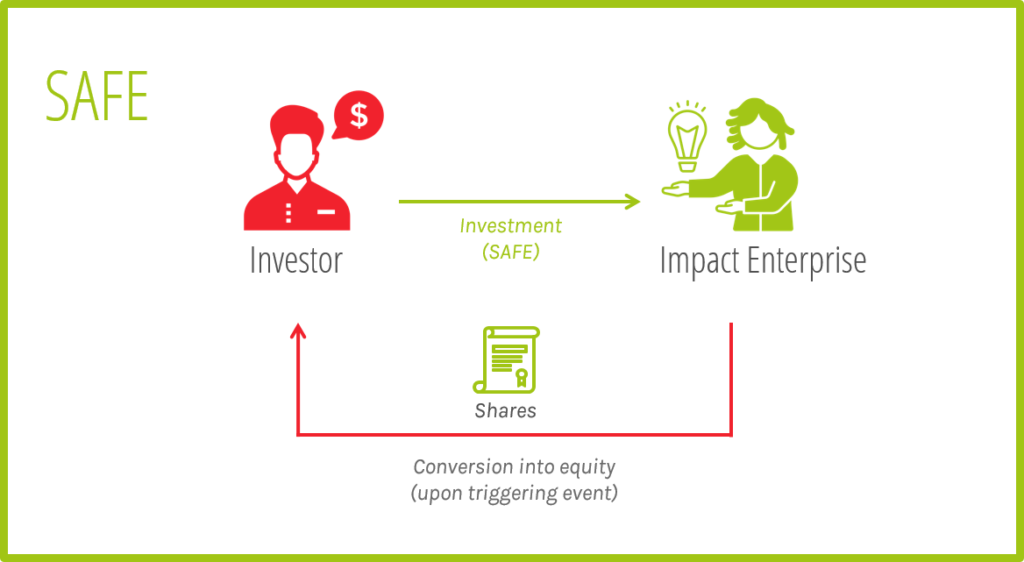

SAFE (Simple Agreement for Future Equity)

Case Study: Y Combinator

Additional Resources: Y Combinator / NLR SAFE And KISSes Next Gen of Startup Financing / Techcrunch Why SAFE Notes Are Not Safe for Entrepreneurs / Thomson Reuters SAFE

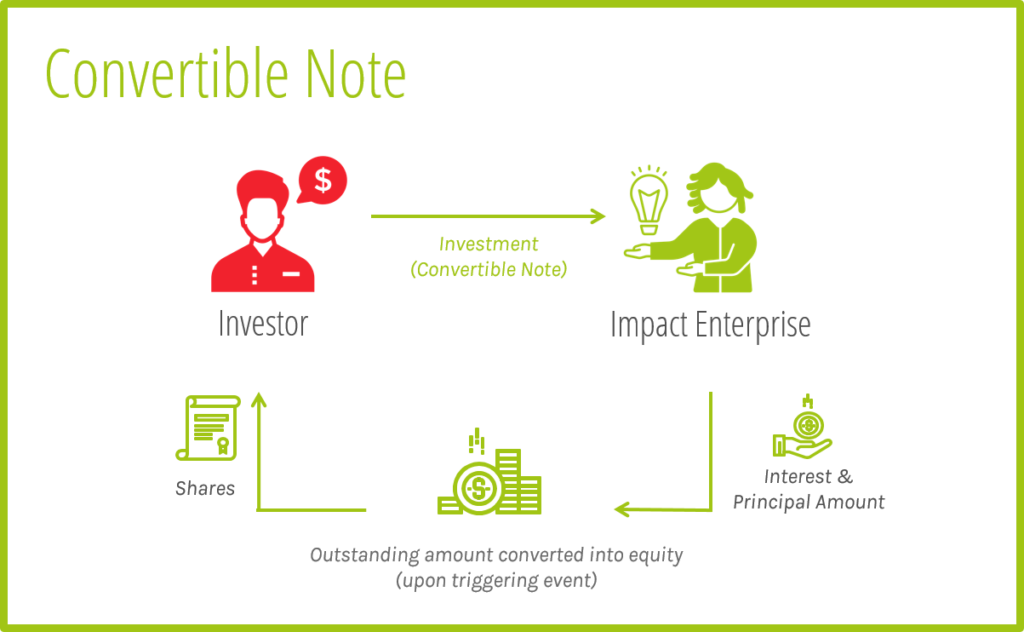

Convertible Note

Case Studies: Ledgy Convertible Notes Real world Examples

Additional Resources: Techcrunch Convertible Note Seed Financings / Seedinvest Convertible Notes Examples and How They Work / Seedinvest Convertible Notes

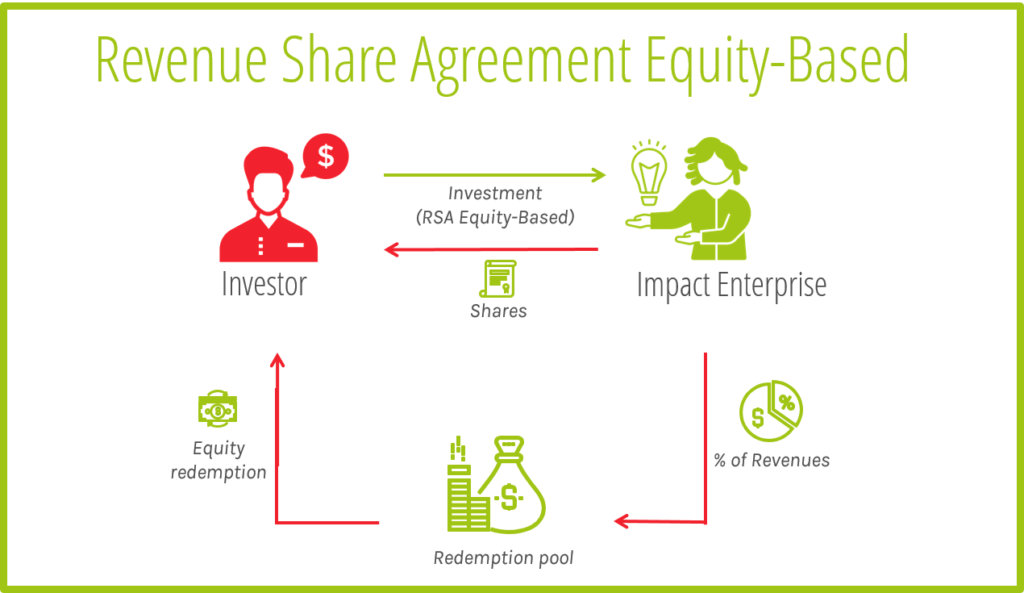

Revenue Share Agreement (equity-based)

Case Studies: coming soon!

Additional Resources: Impact Terms Alternative Exits / Techcrunch Revenue-Based Investing / Impact Terms Revenue-Based Financing

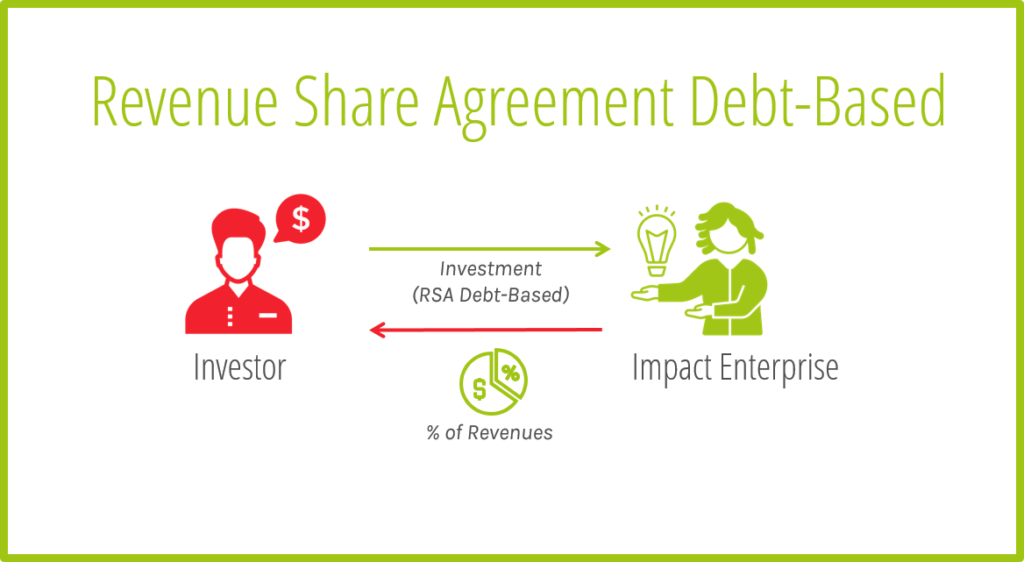

Revenue Share Agreement (debt-based)

Case Studies: VIWALA / podcast

Additional Resources: Future Returns: Investing in Revenue-Based Financing

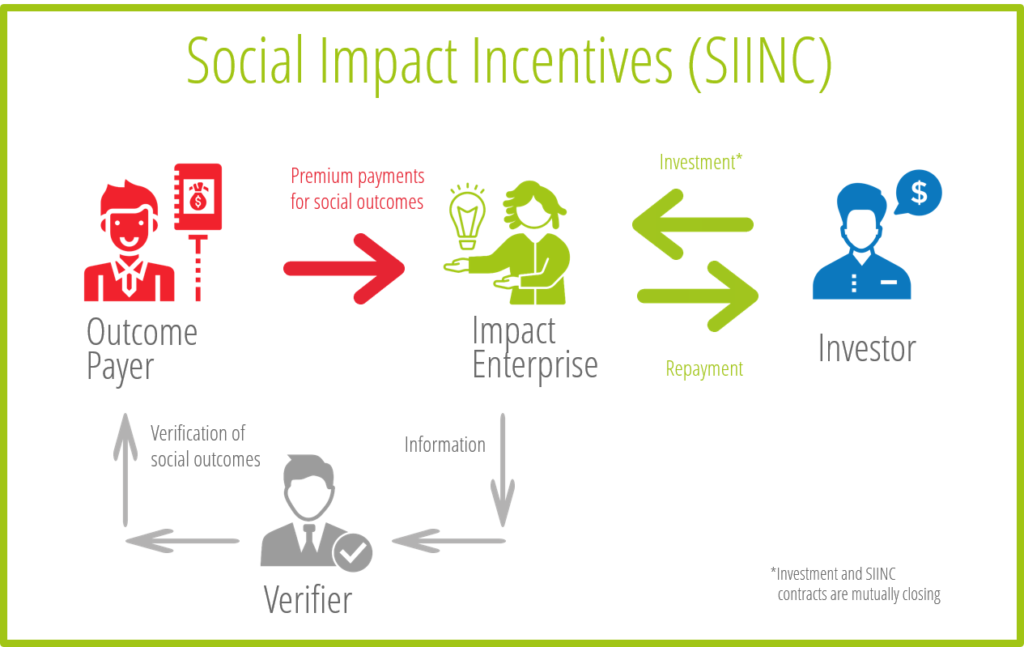

SIINC (Social Impact Incentives)

Case Studies: SIINC Programs / SIINC Case Study Clínicas del Azúcar / HBI Mexican Clinic Boosts Low-Income Patients / Root Capital LaunchesFirst Pay-For-Impact Partnership / Apon Wellbeing

Additional Resources: SIINC White Paper / SIINC Explain Video & Graphs / Emergency SIINC / Devex Social Impact Incentives A New Tool for Supporting Impact / NextBillion Daring to Think Big Why It’s Time to Scale Impact-Linked Finance / NextBillion Pay-For-Success With An Important Twist

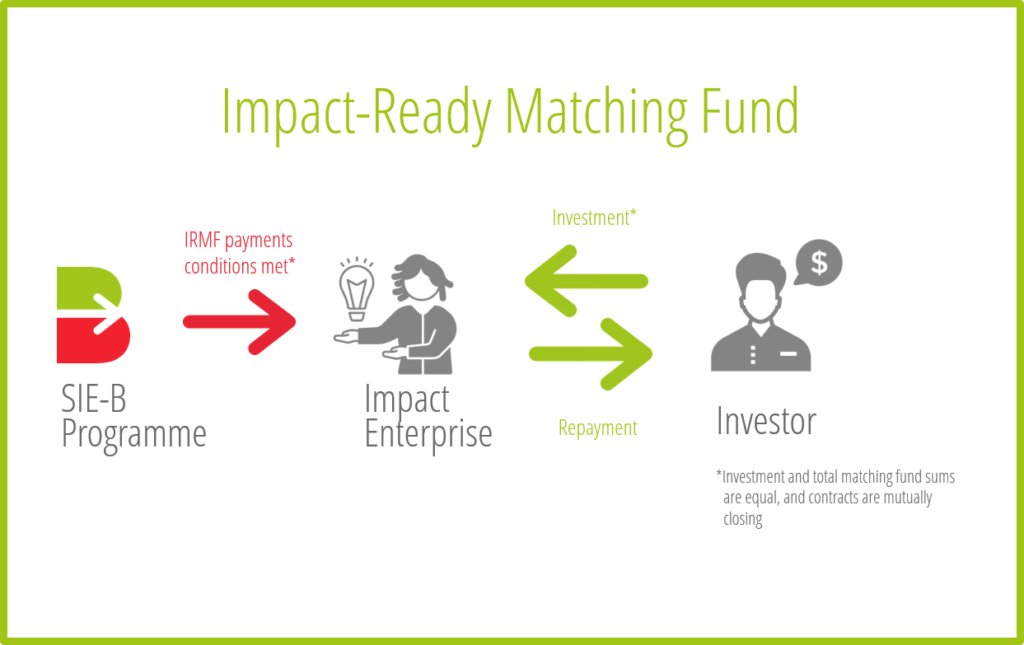

Impact-Ready Matching Fund (IRMF)

Case Studies: Solshare / Romoni / HelloTask

Additional Resources: IRMF page / Impact-Linked Finance FAQ

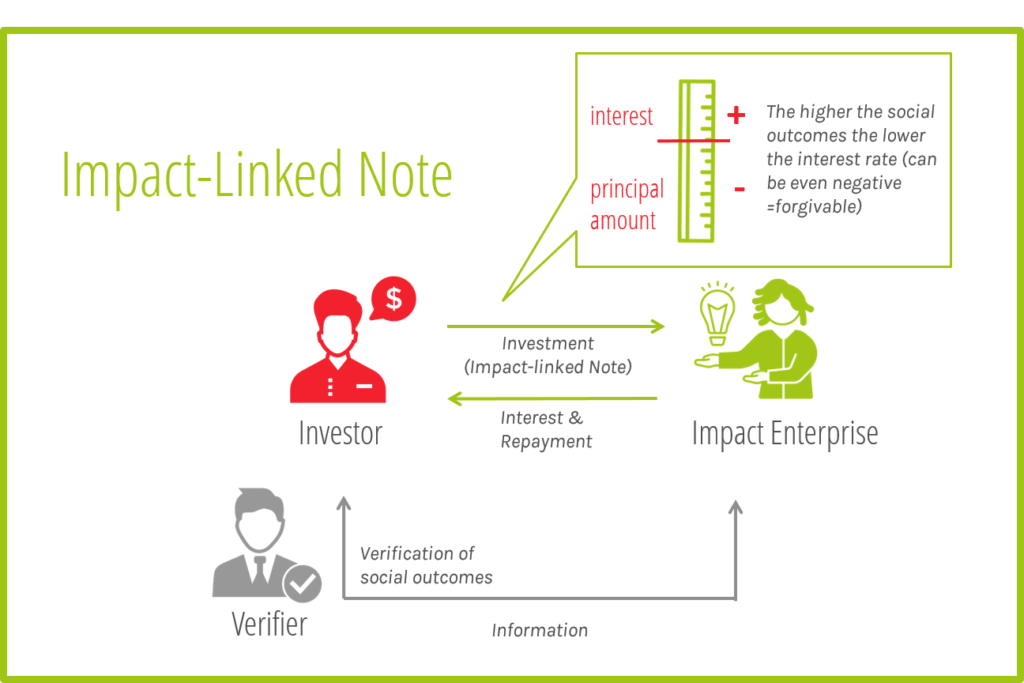

Impact-Linked Loan

Description Impact-Linked Loan

Case Studies: IIG BOLD Contract / BNP Paribas Close Landmark Positive Incentive Loan

Additional Resources: Impact-Linked Finance / Roots of Impact BCG Accelerating Impact-Linked Finance / Roots of Impact Acumen SDC Blueprint for An Outcomes Fund in Off-Grid Clean Energy / Impact-Linked Finance FAQ