SOCIAL IMPACT INCENTIVES (SIINC)

How to get rewards for the impact you achieve

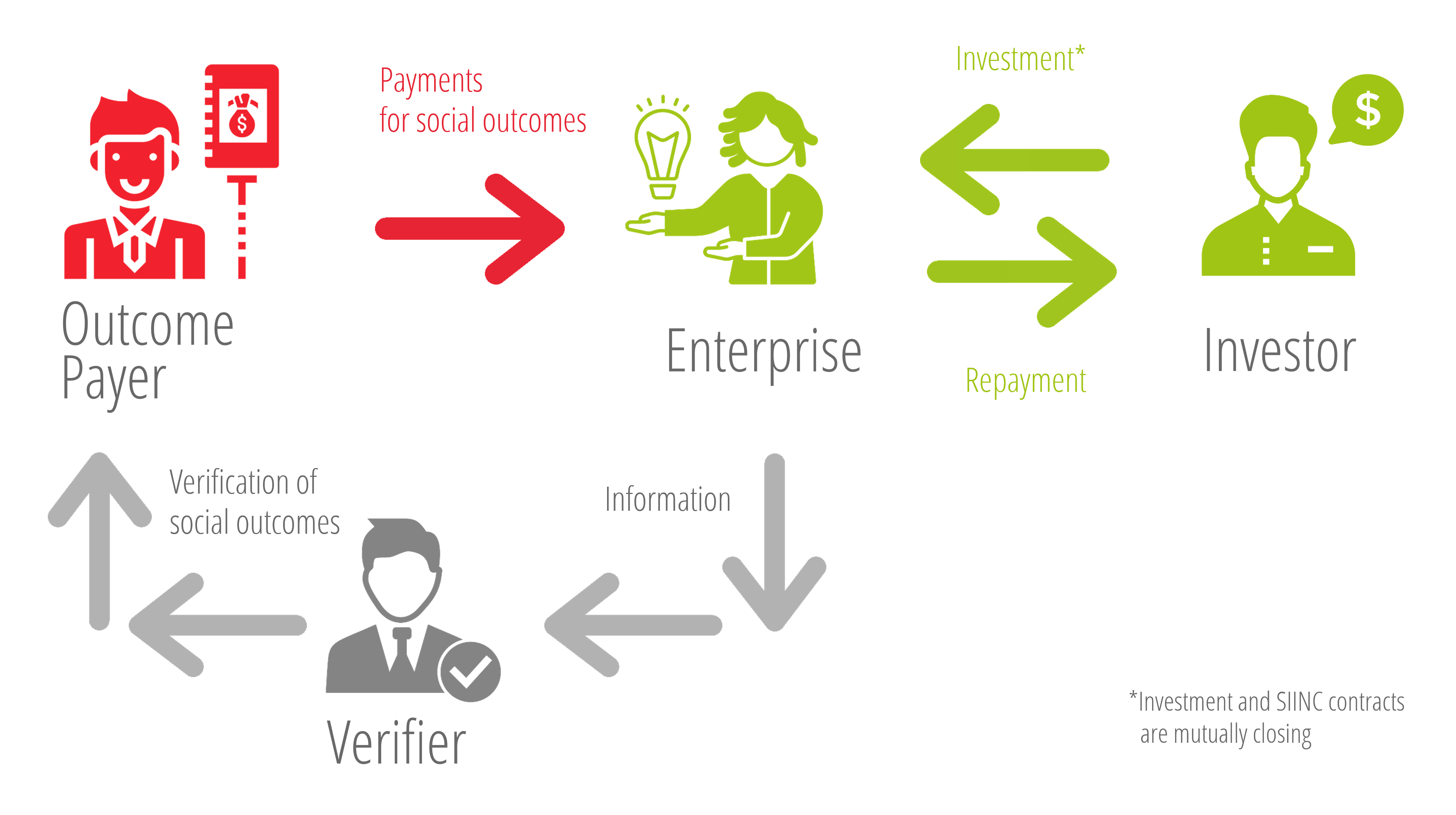

How do Social Impact Incentives (SIINC) work?

Entrepreneurs receive financial rewards for achieving social impact

As part of the B-Briddhi Programme, SIINC funding financially rewards high-impact enterprises that raise investment with time-limited premium payments of between USD 50,000 and 250,000 over a 3-year period. Funding is disbursed in phases based on verified social outcomes generated by their operations. In this way, positive impact is incentivised, and the social performance of the enterprises becomes directly linked to their profitability. This, in turn, increases enterprise attractiveness for impact investors, making it easier to ensure mission-aligned growth capital to scale. You can learn more about SIINC here.

How you can apply

The SIINC application has closed for the time being

This innovative catalytic funding instrument aims to financially reward high-impact enterprises for the measurable social outcomes they achieve. You can find out more details by reading the PDF below.

What are the eligibility criteria

These were the criteria we used to select impact enterprises:

- You are legally registered in Bangladesh

- You have been in operation for more than 2 years

- You already have a business model and paying customers

- You raised repayable investment (not grants) above USD 200,000 within the last six months or are seeking to raise it in the coming year

- You have already achieved financial sustainability (breakeven) or have a very clear plan for doing so in the short term;

- You have systems in place that:

- Have generated baseline data on impact-relevant indicators;

- Allow for the timely collection of meaningful data on an ongoing basis related to these indicators;

- Report consistently on these indicators

- You have a business model that explicitly seeks to address social and/or environmental challenges (or must articulate a willingness to shift their business model towards these aims)

- You have a business model that serves customer groups considered to be under-served within Bangladesh