B-Briddhi Hosts Networking Event To Deep Dive into the Impact in Impact Investing /

Since its launch in 2020, B-Briddhi has been promoting the evolution of impact investing in Bangladesh. But as impact investment gathers momentum in the country, how have the perception, practice and position on impact exactly changed for investors and entrepreneurs? For a deep dive into this important topic, we hosted a networking event in Dhaka, Bangladesh, on 29th November with 75+ ecosystem players, including 20+ investors. Here come some striking insights from some of the most notable players in the Bangladesh ecosystem about how they value the impact in their investment decisions.

Impact investing is taking off in Bangladesh, but how serious are we about impact?

Practitioners in impact investing know all too well that besides generating a financial return (whether market-rate or concessional), measuring and managing impact is the absolute key. With 11 catalytic fundings closed since programme inception, B-Briddhi has lit the journey to how impact can be catalyzed with innovative, Impact-Linked Finance instruments such as SIINC or IRMF. These instruments strive to monetize positive impact for entrepreneurs or prepare them for such a step. Therefore, B-Briddhi also played an instrumental role in increasing the understanding and acceptance of modern impact measurement and management (IMM) tools and techniques.

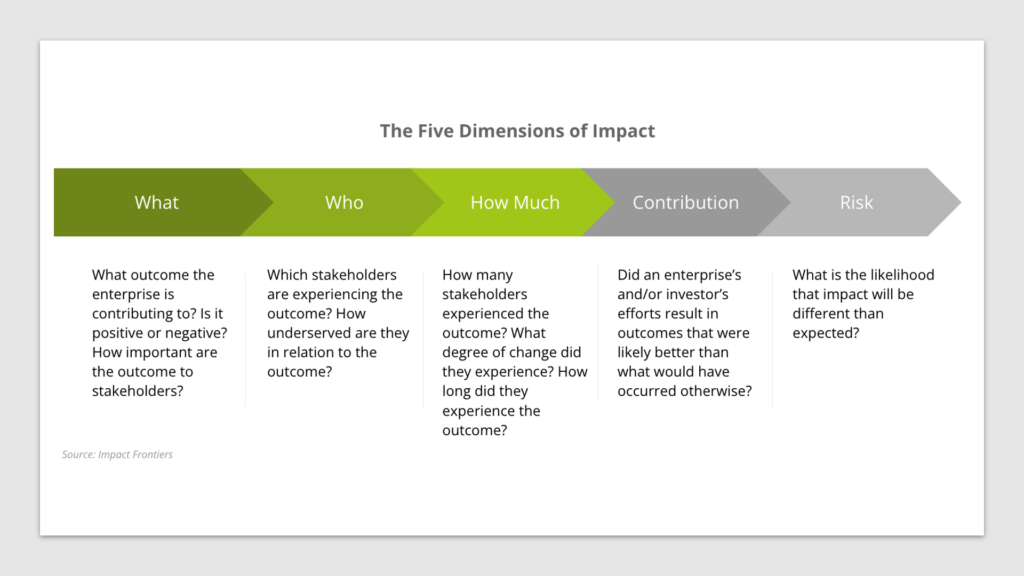

In the meantime, many local ecosystem players have been equipped with vocabularies and internationally accepted frameworks around how to communicate impact. But how much are they actually using them, for example, the five dimensions from the Impact Management Project (IMP) framework? Has this framework been useful in enabling both investors and entrepreneurs to articulate impact with more clarity? For instance, if an investor is able to articulate “who” is being impacted, “what” kind of changes these people are experiencing, and “how much” is essential in distinguishing those who can generate impact effectively, they can prevent the risk of “impact washing”. This risk is even more tangible once an impact investing market is gaining momentum and taking off.

If an investor is able to articulate “who” is being impacted, “what” kind of changes these people are experiencing, and “how much” is essential in distinguishing those who can generate impact effectively, they can prevent the risk of “impact washing.”

Yet capacity building and catalytic funding alone are not enough to move the needle. In parallel, B-Briddhi has engaged in advocacy with the National Advisory Board of Impact Investing in Bangladesh (NAB). The goal is to raise awareness of how to best-practice impact investing can be done as well as advocate for IMM regulatory frameworks that are conducive to scaling up the impact ecosystem. This advocacy cooperation has led to the Bangladesh Impact Investment Strategy and Action Plan (BIISAP) report.

………………………

What investors and entrepreneurs have to say about impact focus

To guide both entrepreneurs and investors in speaking the same “impact language”, the panel discussion set the stage by using the first three dimensions of the IMP framework. Moderated by Bijon Islam, CEO and Co-founder of LightCastle Partners, the panellists were:

- Sami Ahmed, Managing Director at Startup Bangladesh Ltd, the largest venture capital fund in the country backed by the ICT Division, Government of Bangladesh

- Kerry Breen, Partner at SBK Tech Ventures, a technology fund focusing on early-stage, tech-platform companies

- Rahat Ahmed, Founding Partner and CEO of Anchorless Bangladesh, a Bangladesh-focused global fund

- Fahad Ifaz, CEO and Co-founder of iFarmer, one of the earliest Social Impact Incentives (SIINC) recipients of B-Briddhi

……..

-

WHO is being impacted?

One of the sentiments echoed by all of the investors on the panel was that – in an emerging economy such as Bangladesh -, it is difficult to have companies that do not generate at least some form of impact. For example, an enterprise can create impact through employment generation, tax contributions, and building or strengthening supply chains. However, if impact is generated as merely an accidental outcome without intentionality, this limits the possibility of achieving impact at scale.

Thus, it is important to ask the “who” question and see which target population is experiencing the impact. This seemingly simple question allows distinguishing an impact enterprise from any other type of company. To illustrate this effect, Agroshift, a recent catalytic funding recipient of B-Briddhi, serves as a great example: The impact enterprise helps alleviate the burden of female workers in the RMG factories by connecting them with fresh groceries straight from farmers at affordable prices. This innovative business model thus unlocks opportunities to access an underserved customer group who had historically limited access to similar products and services.

If impact is generated as merely an accidental outcome without intentionality, this limits the possibility of achieving impact at scale.

-

WHAT kind of changes are these people experiencing?

Traditionally, when investing in a company, investors tend to go through lengthy due diligence processes to gain a thorough idea of what they are investing in. In a similar fashion, if “impact” is the outcome that you are investing in, it is necessary to have a better idea of “what” kind of impact you are generating. This is as true for investors who pursue a market-rate-return-type of impact investment as it is for more impact-first-minded, concessional-return investors. What you don’t measure, you can’t manage, assess or scale.

But there is more to it: Kerry Breen from SBK Tech Ventures mentioned that they refer to the United Nations Sustainable Development Goals (SDGs) to align with their entrepreneurs the category of impact in discussion. However, it is often helpful to break it down further and understand how impact is translated on the end-user level, and what kind of changes are being experienced. This, in fact, aligns with commercial practices: As an entrepreneur, the better you know about your customers’ relationships with your products or services, the better you are able to adjust and deliver suitable solutions. In that light, IMM is in fact beneficial to business performance or even a decisive contributor to it. Put differently: business and impact performance can go hand in hand.

What you don’t measure, you can’t manage, assess or scale. IMM is in fact beneficial to business performance or even a decisive contributor to it.

-

HOW MUCH impact is being made?

Measuring impact and linking it to financial returns is what many investors and entrepreneurs are still struggling with. Startup Bangladesh Limited and SBK Tech Ventures, two of the biggest investors in the country, are still in the process of developing ways to measure impact and link them to Key Performance Indicators (KPIs), which then feed into the financial returns. Currently, SBK Tech Ventures sets up KPIs for each enterprise based on the type of impact they are setting out to make and assigns a third-party company to evaluate these KPIs. For example, impact metrics for a healthcare enterprise such as Praava Health include the number of patients served, as well as monitoring reports of their services conducted by a third party.

Measuring output-level data (e.g. the number of people reached/served) is certainly a good start. However, to create a more accurate understanding of the level of impact created, B-Briddhi goes beyond measuring outputs: It focuses on outcome-level metrics (e.g. health outcome improvement experienced by customers). Then, the catalytic financing transactions that B-Briddhi provides link financial incentives directly to this outcome-level performance. To give an example: For iFarmer, one of the key metrics was the level of reinvestment made into machinery from smallholder farmers as a result of financial support received from iFarmer. This outcome-level metric provides insights into the economic resilience of the farmers in the longer run and enables a more detailed understanding of the changes experienced by these customers, as opposed to just counting the number of customers served.

While impact investing remains a nascent landscape in Bangladesh, the CEO of iFarmer, Fahad Ifaz, emphasized the importance of investing in the IMM capacities of the companies. For enterprises that want to raise impact investment, it is key to invest in resources to identify and quantify their impact. This may require setting up and developing the skills of a team dedicated to impact measurement at the company level. In fact, some internationally leading impact investors do provide assistance to their entrepreneurs in building up their IMM systems in order to facilitate the growth of their portfolio companies.

Measuring output-level data (e.g. the number of people reached/served) is certainly a good start. However, to create a more accurate understanding of the level of impact created, we need to go beyond and start measuring outcome-level metrics.

What is most important to take away from this event?

As also verified by recent research, investors do indeed care about impact when it comes to their investment decisions. Yet they need to care more and plan better on how to optimize the impact. A crucial step on this journey is finding a framework to evaluate HOW MUCH impact is being made by the enterprise. B-Briddhi can support this step: by equipping the ecosystem with knowledge and skills in identifying, collecting, and measuring meaningful impact data. The networking event served as a great opportunity for venture capitalists, angel investors, banks, financial institutions, ecosystem builders, and startups, to collaborate, discuss and reflect on the importance of defining and measuring impact.

Now let’s get serious about the impact in impact investing!